Here’s how you can avoid medical identity theft

Here’s how you can avoid medical identity theft

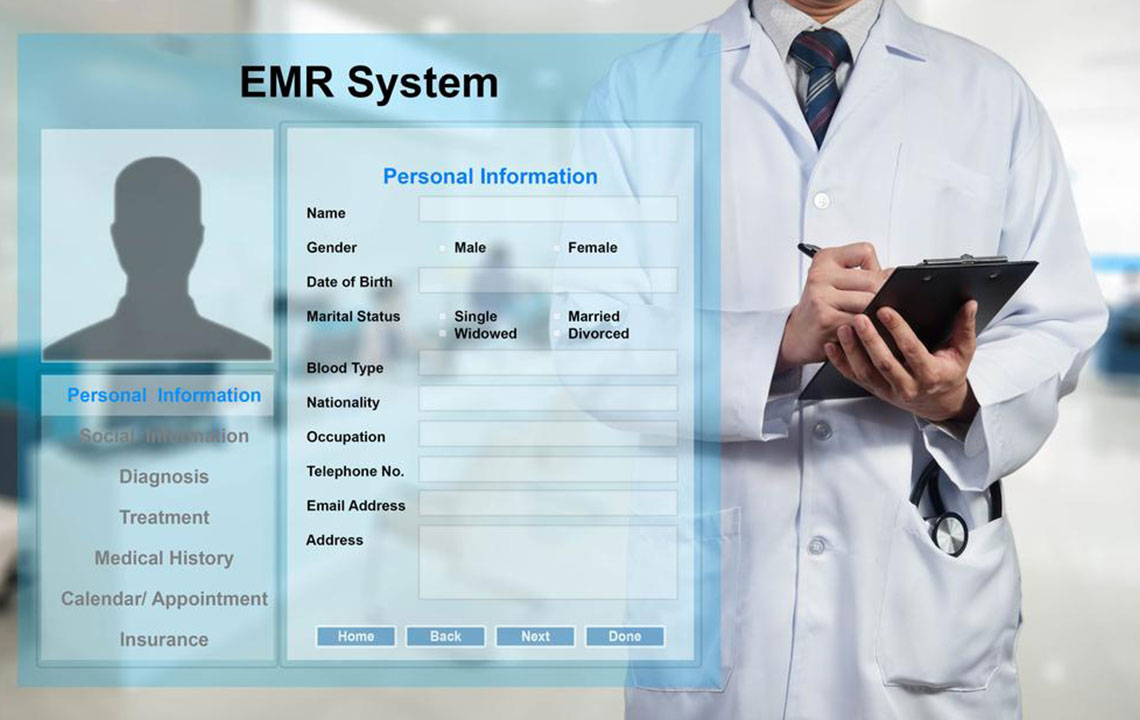

Due to the digitization of medical records, the chances of identity theft have also increased to a great extent. Not only the data should be secured, but it needs to be also available for research. Although the companies around the world are trying to find security solutions, here’s what you should do to avoid identity theft.

Sharing of information

When you want to share information, make sure to provide only necessary details. Confidential data is prone to leakage and can cause more harm than good in the long run, therefore exercise caution and confirm whether it is important to reveal the same. In fact, do not give information on the phone, but visit the hospital personally to provide data. It would help you to protect the privacy of the information and prevent misuse if any.

Be careful with emails

More often than not phishing emails are sent to the user to get required information. One should not click on the email addresses that are unrecognizable. Even if you get a legitimate email, verify from the trusted sources before clicking on the same.

Keep either paper or digital records

You can either keep paper or digital records because if the information is maintained simultaneously in two modes, it would be prone to identity theft.

Public Wi-Fi

Patients should not use public Wi-Fi internet to enter information. If you want to use the connection, make sure that the device is protected by the security software.

Beware of the cloud services

If you are using cloud services, check the security systems in place. Not all of them are reliable; therefore store the information in the customized encrypted format. You can opt for services equipped with multiple security layers. In addition, one should also not share information on the social media because of the chances of spills over increases manifold.

Conclusion

While initiating online communication with the health care provider, one needs to be very careful. To start with, ascertain that the person asking for information is genuine. You can also log on to the internet and check your credit score.

Recent Articles

Recent Questions

What kind of life insurance builds cash value?

The rest of the premium payment will go toward your policy's cash value. The life insurance company generally invests this money in a conservative-yield investment. As you continue to pay premiums on the policy and earn more interest, the cash value grows over the years.

What is meant by insurance plans?

An insurance plan is the one that consists of a premium amount and other components used in getting a product insured. There may be various types of insurance plans with varying terms and policies.

What are the common components of insurance?

The most important components of most insurance plans are the premium and the contract. Anything written in the contract becomes its crucial component.

What are the various types of insurance policies?

There are various kinds on insurance policies that are available on various assets. Auto, health, commercial vehicle, and travel insurance are some of the popular types of insurance policies.